[ad_1]

Ian insurance claim occurs at a stressful moment in a client’s lifeoften turning it into a negative experience. At least that’s what you can assume. That’s why I was surprised when our latest research report, Why AI in Insurance Claims and Underwriting

The speed of settlements contributes to the satisfaction of insured events

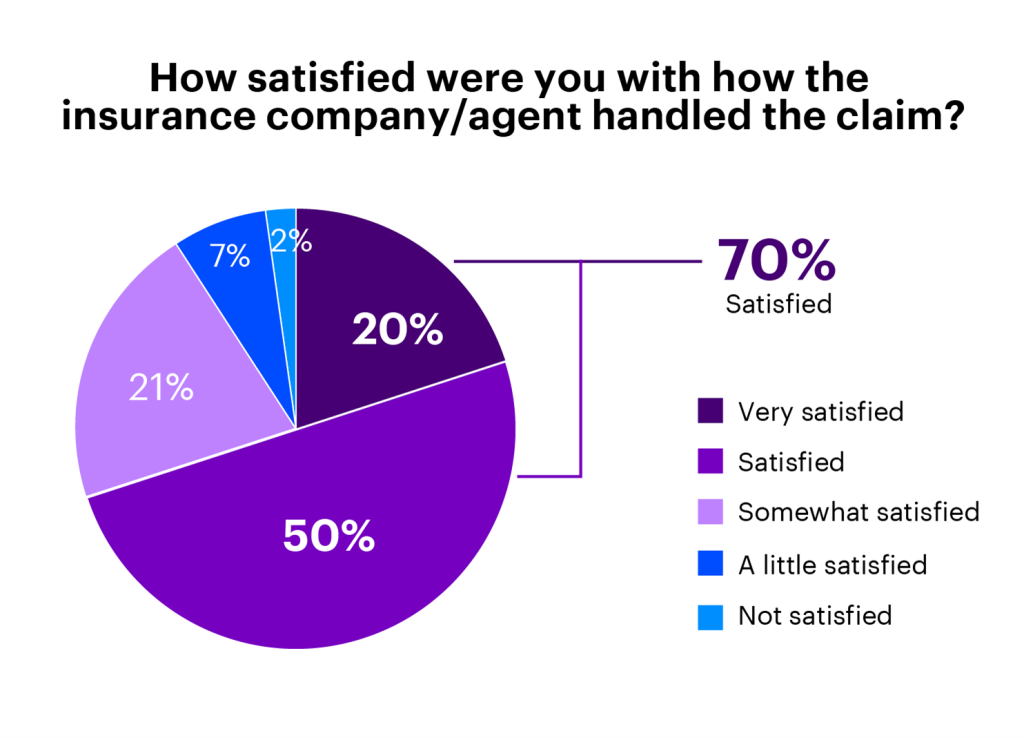

Overall, our survey found that 70% of policyholders said they were either satisfied or very satisfied with the way their insurance company or agent handled their claim.

That’s a lot to claim. And our survey is not the only data point showing this. JD Power’s 2021 auto insurance survey showed an all-time high customer satisfaction rate for claims, reaching 880 on a 1,000-point scale. A similar 2021 JD Power study on property claims showed a slight decrease in satisfaction (from 883 to 871), but this broke a 5-year streak of steady growth in satisfaction and is likely due to circumstances not directly related to insurers (such as an offer ). chain failures and shortages of materials associated with the pandemic). So what is causing these rising satisfaction rates?

Omnichannel communication and transparency are two reasons. Most insurance companies allow customers to open claims on a website or app. The technology offers convenience in terms of using photographs for verification instead of scheduling a person to be on site. And some insurance companies offer a dashboard to track a claim throughout its lifecycle.

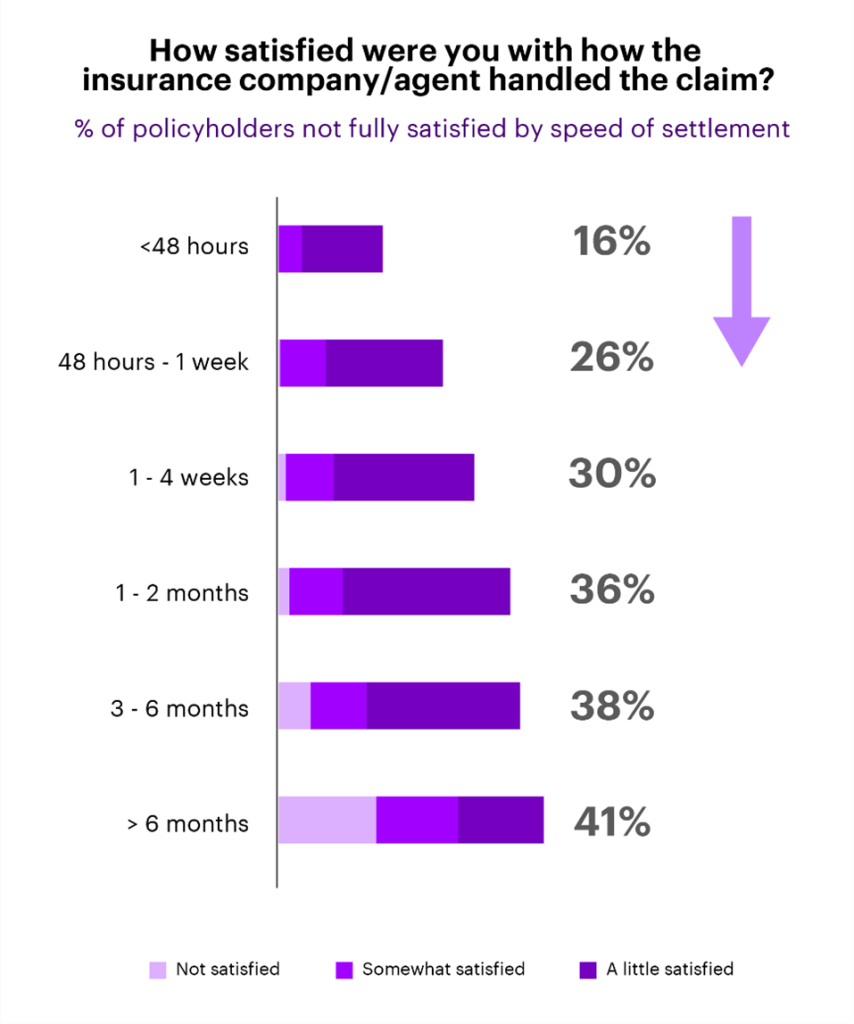

All of these important updates have helped make claims processing smoother. However, according to our survey, there is one thing that has the biggest impact on satisfaction: settlement speed. The longer it takes to settle a claim, the less satisfied the policyholder will be.

This insight is especially important for insurers, as claims dissatisfaction is a major factor driving insurers to change companies: 74% of dissatisfied customers either say they have changed providers (26%) or are considering doing so (48%).

Insurers need to focus on AI to achieve high claims satisfaction rates.

Knowing that speed of resolution is a major factor, how do insurers continue to get high levels of satisfaction and, more importantly, build on it?

For years, insurers have focused on omnichannel. We are now at a stage where constant investment in omnichannel is yielding diminishing returns. Of course, this does not mean that omnichannel should be ignored. New routes targeted at the younger generation, such as chat apps (WhatsApp, etc.), will continue to be an important strategy for insurers to expand their customer base. And improving or modernizing any multi-channel offerings that insurance companies currently offer will be critical to staying relevant. What I’m talking about here is that omnichannel is the easy hanging fruit, most of which we’ve already picked.

Instead, insurers should focus on AI to automate the settlement process so it’s fast, simple, and accurate. Of course, this is easier said than done. Automating the calculation process requires reliable data and analytical capabilities linked in a single ecosystem.

The gap between intention and action

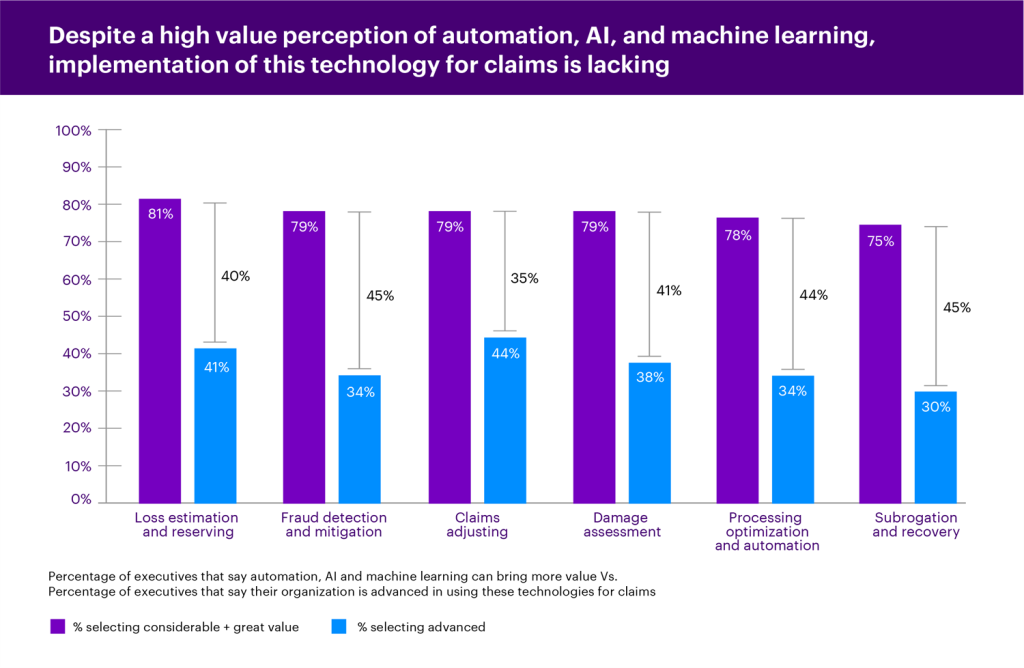

Executives are already realizing the importance of using AI in claims. The chart below shows that in every area of the value chain, at least 75% of executives said that AI and machine learning could deliver “significant” or “great” value.

However, there is a gap between this intention and action. The same graph shows this gap, where even in the most advanced area (claims resolution), only 44% of executives say they are advanced in the use of AI, automation, and machine learning. In this scenario, our definition of “advanced” corresponds to the “beginner” level.

Insurance executives must consider priorities holistically

So, about 80% of managers realize the value of AI in claims, and about 40% consider themselves advanced in various areas. Not surprisingly, investment in claims will accelerate over the next three years: 65% of those we surveyed plan to invest more than $10 million.

However, insurers should not be discouraged because the priorities for resolving the problem are the same as other management priorities, such as reducing administrative costs and curbing leakage of claims, and the solutions are the same. That’s why leaders should avoid trying to solve each problem individually, and instead ask how artificial intelligence, machine learning, and other automation tools can transform a business so that it solves several priority tasks at the same time. For example, increasing the speed of settlement through automation will naturally reduce administrative costs and prevent claims from leaking, as well as increase customer satisfaction and retention.

Insurance leaders also need to be bold to tackle these more complex challenges and not waste too much time and energy on simpler priorities (such as multi-channel).

Insurers know the value AI can offer but are lagging behind in implementation. Fortunately, the recent leap towards the cloud will help. The cloud is an important foundation for real-time data and modeling that will facilitate this type of automation.

Overall, there is still a lot of work to be done to bring technology platforms to the point where they can automate the speed of computing and use AI more effectively in business. But it’s clear that artificial intelligence and automation is where insurers need to invest in to get the most bang for their buck: happy customers, empowered employees, and a more sustainable business. To learn more, read our full report on AI-led insurance transformation.

Get the latest insurance industry insights, news and research straight to your inbox.

STANDARD DISCLAIMER:

Disclaimer: This content is provided for general informational purposes and is not intended to be used as a substitute for consultation with our professional advisors.

[ad_2]