[ad_1]

In this series of blogs, we reviewed the latest entry from the only longitudinal review of underwriters in North America. The study, which is being conducted in partnership with Accenture and The Institutes, provides a vital context for tracking the underwriting trajectory that is at the core of any insurance company’s business.

And our most recent data, collected in 2021, is not encouraging.

This makes this post refreshing as we take note of what insurers have told us about the impact technology is having on their operations. This is not always positive, but silver overlays are much easier to detect in these data.

Impact of Technology on Core Underwriting

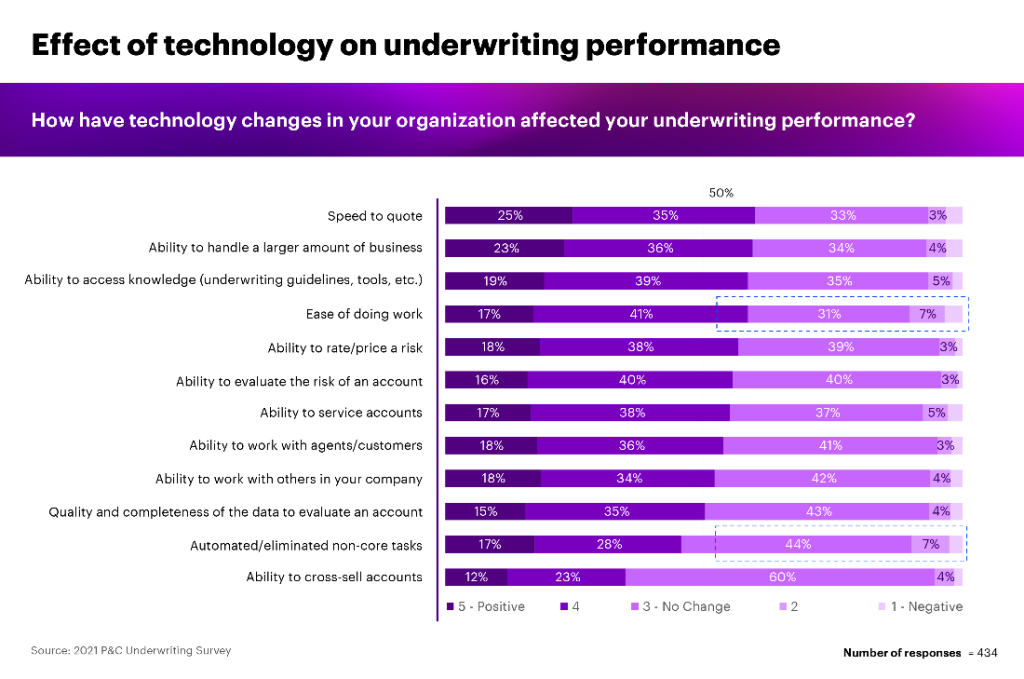

The good news comes straight from the data: overall, carriers say technology investments in their organizations have had a positive impact on pricing, sales, risk assessment and pricing, and customer service.

This figure shows that more than half of all survey respondents said that technological changes in their organization had a positive impact on most aspects of underwriting in their organization.

The five areas of underwriting most improved by technology were:

- The speed of creating a commercial offer

- Ability to work with large volumes of business

- Ability to access knowledge

- Ease of getting the job done

- Ability to assess and assess risk

All in all, this is much-needed good news in the survey data.

But notice the categories at the bottom of the figure: only 45% of underwriters told us that technology has automated or eliminated the non-core underwriting tasks they perform. Many (44%) say technology hasn’t had an impact here, while 11% say it has been negative.

This finding should be seen in the context of the rest of the study. Recall, it also turned out that the average underwriter today spends on non-core underwriting tasks.

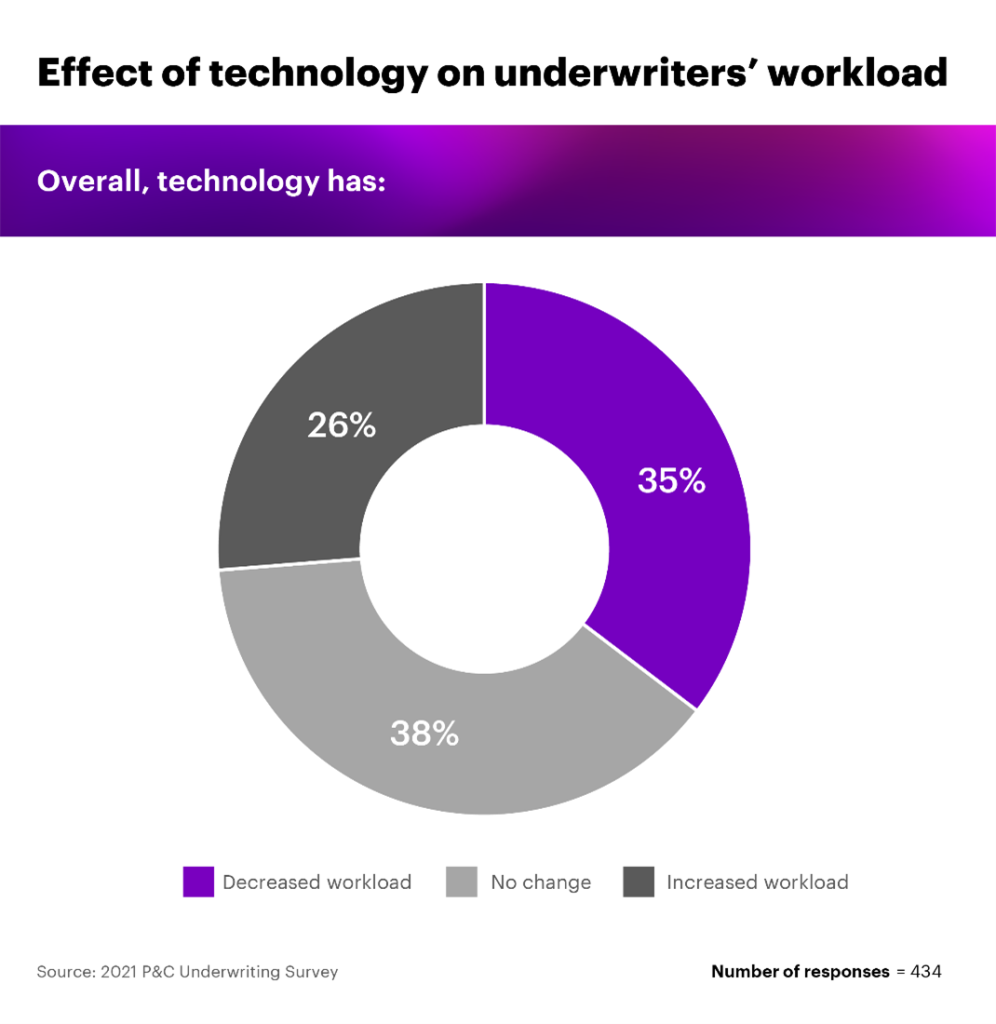

This is reflected in other survey data as well. For example, we asked underwriters how technology has impacted their workload.

Only 35% said their workload has decreased, while 64% said their workload has not changed or has increased due to technology.

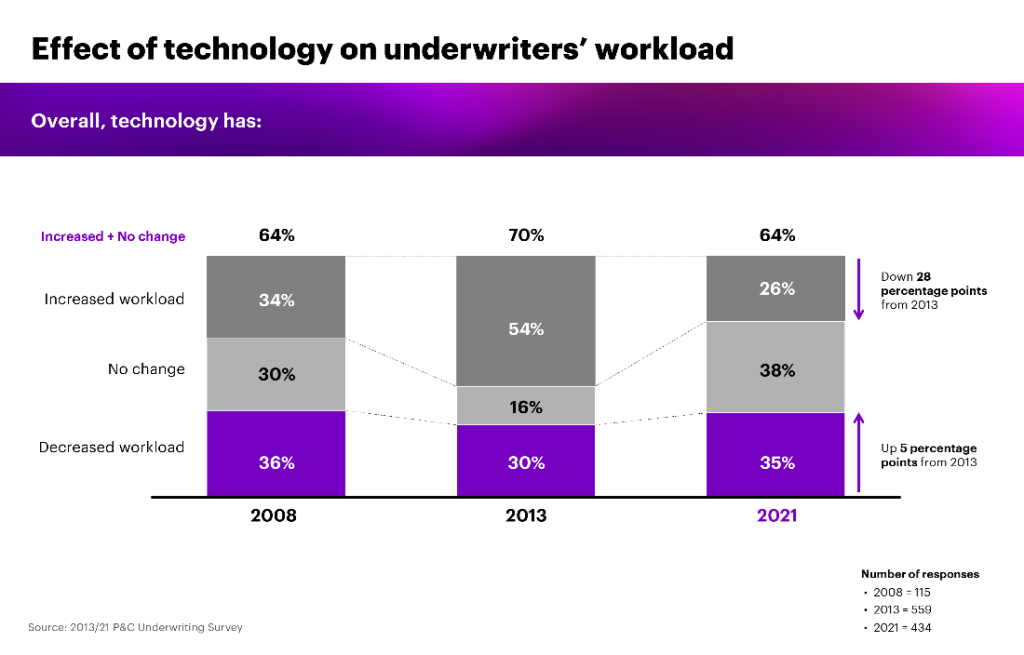

However, when we look at these data in a historical context, there is another positive side.

The share of underwriters whose workload is boosted by technology is down 28 percentage points from the 2013 survey. In fact, the 26% who say technology is increasing the amount of work they do is the lowest percentage we’ve seen in the 13 years our data covers.

Break out of the hamster wheel

For me, the last decade of investing in technology in underwriting is a bit like running a hamster on a wheel – a lot of energy was expended, but we did not achieve anything.

Or at least not as far as we need. It is true that most carriers have invested heavily in their underwriting tools. As I wrote earlier in Underwriting’s Digital Leap, the first generation of these tools focused on providing rating systems and key policy management, while the second generation was created to complement the first with workflow solutions.

However, most underwriting environments are still scattered and disaggregated. The time it takes to use each individual system, or transfer information between them, means that more often than not, a new tool takes at least as much time as it should save insurers.

For example, one operator we worked with recently counted all the digital solutions that an underwriter would theoretically have to use in one business day. The result reached 92.

This division of the underwriting workflow into dozens of tools explains why the survey data shows that operators are not getting the expected return on their underwriting investment.

To be clear, I do not mean that these investments were worthless or that the creation of these digital tools does not open important exciting new ideas and opportunities for underwriters – quite the contrary. The tools and systems that underwriters now have at their disposal are amazing. For example, they can shed light on dark data to make better underwriting decisions, among other things.

But as our research shows, all too often it doesn’t make much difference to underwriting workflows and to the operator’s business as a whole. Insurance organizations that achieve high levels of human experience ambition are all too rare in the industry today.

To change that, we need to see how underwriters use what I call third-generation digital tools in underwriting. This new generation will combine dozens of tools currently available to underwriters into a single platform that seamlessly integrates into your workflow.

And the really exciting side of it? Signs of this trend are already starting to show in the industry. We will cover this in more detail in this blog in the future.

In the meantime, in the next post in this series, we’ll take a look at what we’ve learned about talent management underwriting from our longitudinal survey.

Get the latest insurance industry insights, news and research straight to your inbox.

Disclaimer: This content is provided for general informational purposes and is not intended to be used as a substitute for consultation with our professional advisors.

[ad_2]